Saving money can be challenging especially if you don’t have a stable income. The Employees Provident Fund (EPF) exists to help everyone save up enough for retirement but according to EPF’s chief strategy officer Nurhisham Hussein, you’d need RM900K to RM1 million if you plan to retire comfortably in 20 or 30 years.

The amount may seem a lot to achieve but it is not entirely impossible. This local man shared his secrets of how he managed to save up more than RM1 million in his EPF account by the time he turned 45 years old! Here’s how he did it:

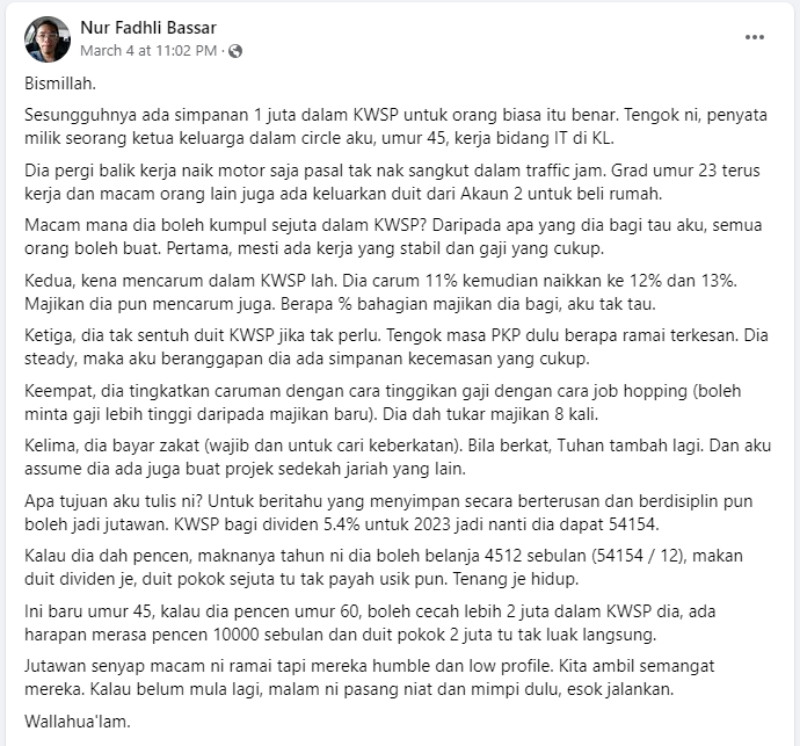

Recently, a man named Nur Fadhli Bassar posted on Facebook a screenshot of the amount of money a 45-year-old friend managed to save in his EPF account and shared some tips on how others can do the same. According to the unnamed individual, this is what one should do in order to save RM1 million or more in their EPF account by the time they want to retire:

- Have a stable income job and sufficient salary.

- Contribute 11% to EPF then progressively increase it to 12% and 13% (employer’s contribution also plays a role in this).

- Do not touch your EPF money unless you’re in dire need of it to survive.

- Increase your EPF contribution by earning higher pay cheque (through job hopping or salary increments).

- Lastly, for Muslims, pay your Zakat and donate more as God will reward you for your sincere generosity and kindness.

“Why am I sharing this? To encourage others to continuously save and be more disciplined so that they too can be millionaires. EPF gave a 5.4% dividend for 2023 so [my friend] would have received about RM54k. If he is already retired, that means this year he can spend about RM4.5k a month,” said Nur Fadhli.

He also added that if his friend were to retire at age 60, then he’d be able to save up to RM2 million or more in his EPF by that time. He ended his post by saying that there are many humble low-profile millionaires in Malaysia and encourages everyone to start saving right now.

Did his story inspire you? Will you take these tips into consideration for your retirement plans?