Having an Employees’ Provident Fund (EPF) account can be beneficial, as it provides financial support when you reach retirement age. However, there have been reports suggesting that a certain level of savings is required to retire comfortably.

This has placed considerable pressure on Malaysians, as many feel they need to work harder and longer—possibly beyond the retirement age—to reach that financial goal. As if that wasn’t challenging enough, a new finding suggests that we should have a certain amount saved by the age of 35. So, how much do we actually need?

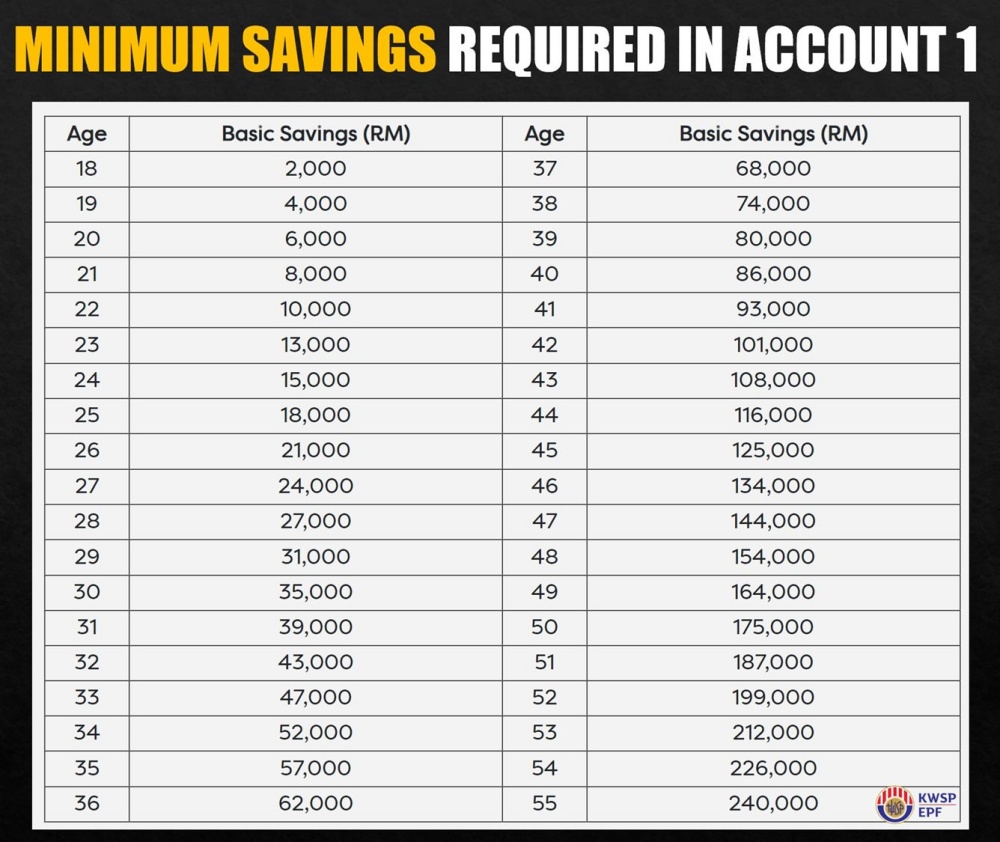

Yesterday (Wednesday, 6 November), the Twitter page @TheFuturizts shared some interesting information they discovered while browsing the EPF official website. According to the post, Malaysians should already have RM57,000 in Account 1 by the time they turn 35. “Since this only makes up 75% of your EPF balance, you should have RM76,000 in your entire account by this age,” the admin wrote.

From the table shown above, it is suggested that one must already be working and have an EPF account from the age of 18 to reach this financial goal. If you’re wondering why users must have this certain amount, it was explained that this is to ensure that Malaysians would have savings of RM240,000 in Account 1 by the time they reach the age of 55. With an EPF contribution of 5.5% per year, one would receive a dividend of RM1,100 each month if you have accumulated the above savings amount.

This raises the question: since many of us don’t start working until our early to mid-20s, after completing our studies, how can we ensure we reach RM57,000 by the time we’re 35? The answer is relatively simple: reduce spending and invest the rest, according to RinggitPlus founder Hann Liew. While this may seem challenging at first, it’s not impossible.

Previously, a 35-year-old woman shared that she managed to save nearly RM2 million in her EPF account. Her high-paying job definitely contributed to her milestone but she also upheld 3 main practices to accumulate the amount of money she now has. You can read more about how she did it here.