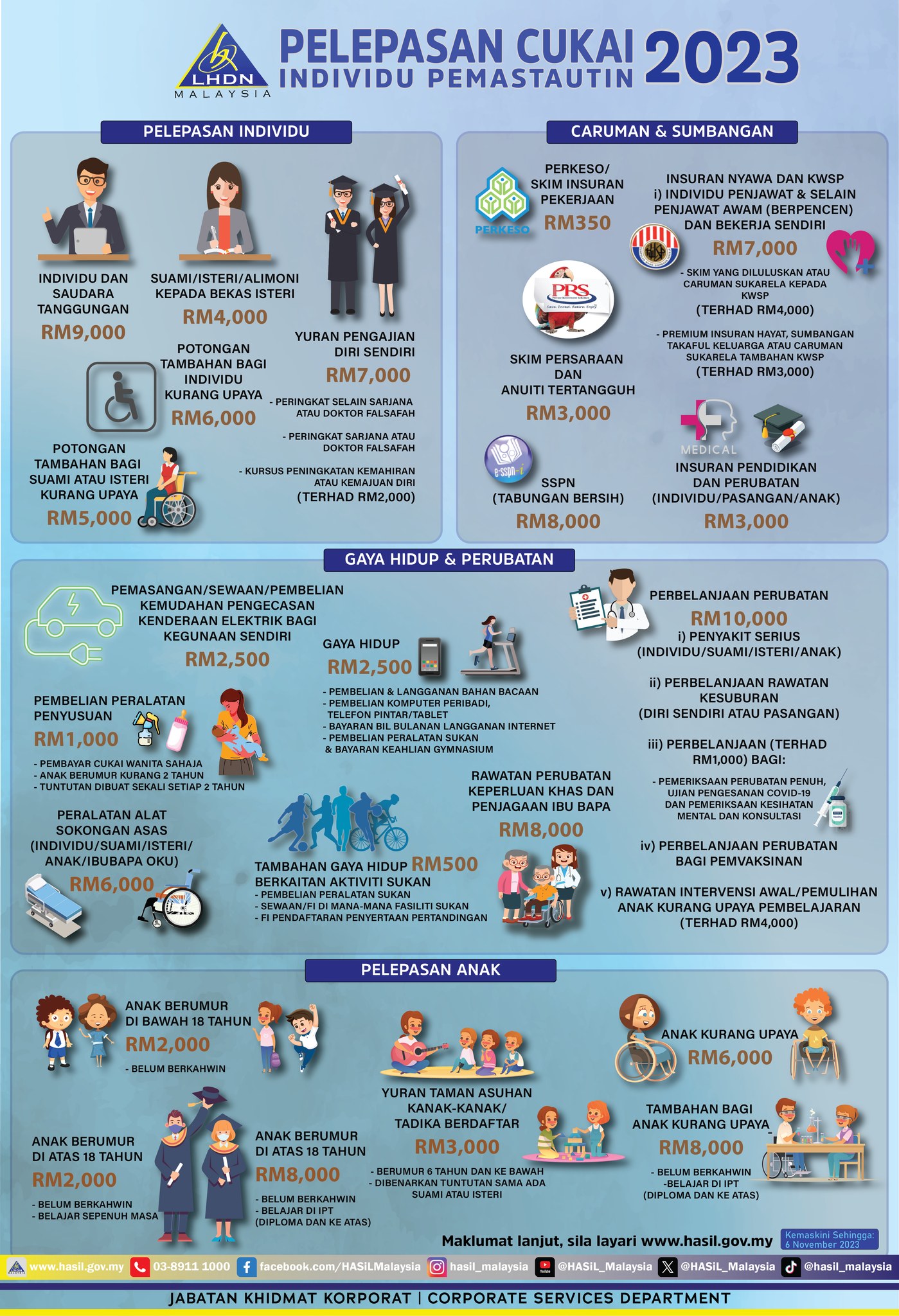

Income tax filing season is upon us again! From now till 30th April 2024, everyone earning an income in Malaysia – even those who don’t earn enough to be taxed – are expected to file their income tax returns.

When it comes to filing taxes, personal deductions and reliefs help reduce your chargeable income and taxes, so it’s crucial to know which ones they are. To help make the process easier, the Inland Revenue Board (LDHN) has published a list of income tax reliefs you can claim for 2023. The list includes all the amounts you can claim for Individual and dependent relatives relief, spouse relief, child relief and more.

Here is everything on the list:

- Individual (unmarried) and dependent relatives relief – RM9,000.

- Individuals with disabilities registered with the Social Welfare Department (JKM) are entitled to an additional RM6,000 relief.

- Spouse relief – up to RM4,000.

- Only applicable for a spouse with no source of income and if opted for joint assessment under taxpayer’s name.

- Taxpayers are entitled to an additional RM5,000 relief if their spouse is disabled.

- Self-education fees – up to RM7,000.

- Only applicable for:

- Postgraduate (master’s or doctorate) – any course of study.

- Undergraduate – law, accounting, Islamic financing, technical, vocational, industrial, scientific, or technology.

- Upskilling courses recognised by the Department of Skills Development are limited to only RM2,000.

- Employees Provident Fund (EPF) contributions and life insurance – up to RM7,000.

- Employees contributing to EPF (mandatory or voluntary) are entitled to up to RM4,000 relief.

- Taxpayers with personal life insurance premium payments, family takaful contributions and additional voluntary contributions to EPF are entitled to up to RM3,000 relief.

- Education and medical insurance – up to RM3,000.

- Social Security Organisation (SOCSO) contributions – up to RM350.

- Private retirement scheme or deferred annuity scheme contributions – up to RM3,000.

- Skim Simpanan Pendidikan Nasional (SSPN) deposits – up to RM8,000.

- Electric vehicle (EV) charging equipment – up to RM2,500.

- Applicable for taxpayers who purchased, installed or rented EV charging equipment or subscribed to EV charging facilities.

- Breastfeeding equipment – up to RM1,000.

- Applicable to mothers with a child aged two years and below.

- Purchase of supporting equipment for self (if a disabled person) or for disabled spouse, child, or parent – up to RM6,000

- Lifestyle purchases for self, spouse, or child – up to RM2,500

- Applicable for:

- Purchase or subscription of books, journals, magazines, newspapers, or other similar publications

- Purchase of personal computer, smartphone or tablet for personal use

- Purchase of sports equipment for sports activities and payment for gym membership

- Payment of monthly bill for internet subscription (under taxpayer name)

- Additional relief for sports-related purchases – RM500

- Taxpayers can claim additional tax relief for:

- Purchase of sports equipment for any sports activity as defined under the Sport Development Act 1997 (excluding motorised two-wheel bicycles)

- Payment of rental or entrance fee to sports facilities

- Payment of registration fees for sports competitions where the organiser is approved and licensed by the Commissioner of Sports under the Sport Development Act 1997

- Medical expenses for parents – up to RM8,000

- Expenses on medical treatment, special needs, and carer for parents if they have a medical condition certified by a medical practitioner.

- Medical expenses for self, spouse, or child – up to RM10,000

- Applicable for medical expenses for:

- Serious diseases for self, spouse, or child

- Fertility treatment for self or spouse

- Vaccination for self, spouse, and child (capped at RM1,000)

- Other medical expenses applicable for relief for up to RM1,000:

- Complete medical examination for self, spouse, or child

- COVID-19 detection test, including the purchase of a self-detection test kit for self, spouse, or child

- Mental health examination or consultation for self, spouse, or child

- Other medical expenses for children under 18 years old applicable for relief for up to RM4,000:

- Assessment of intellectual disability diagnosis

- Early intervention programme or intellectual disability rehabilitation treatment

- Child relief – RM2,000 per child

- Only applicable for RM2,000 for each unmarried child under the age of 18 years.

- Taxpayers with a disabled child registered with JKM are entitled to an additional RM6,000 relief

- Additional relief for children (above 18 years old) in full-time education – up to RM8,000 per child.

- Taxpayers with an unmarried child (aged 18 and above) enrolled in full-time education (A-Levels, certificates, matriculation or preparatory courses) are entitled to RM2,000 relief for each child.

- Taxpayers with an unmarried child (aged 18 and above) pursuing further education (diploma level or higher) in Malaysia or outside Malaysia are entitled to RM8,000 relief for each child.

- Additional relief for disabled children (above 18 years old) pursuing higher education – up to RM8,000 per child.

- Childcare fees – up to RM3,000.

- Applicable for payment of fees for a registered childcare centre or kindergarten for a child aged six and below.

Taxpayers have until 30th April 2024 to file their income tax. For those using e-filing services, there is a grace period of 15 days – so the deadline would be 15th May 2024. You can log on to the LHDN website to file your tax returns and for more information on tax reliefs.

Sources: Facebook, LHDN Malaysia