Nobody likes owing anyone anything. Especially money. Mainly because if they charge interest, things can get out of hand, fast.

Recently, someone made a complaint that they were struggling to repay their loans to the bank. However, it wasn’t a situation with their money. The person had simply discovered that the bank had raised their interest rate on the loan and was making it difficult to pay it off!

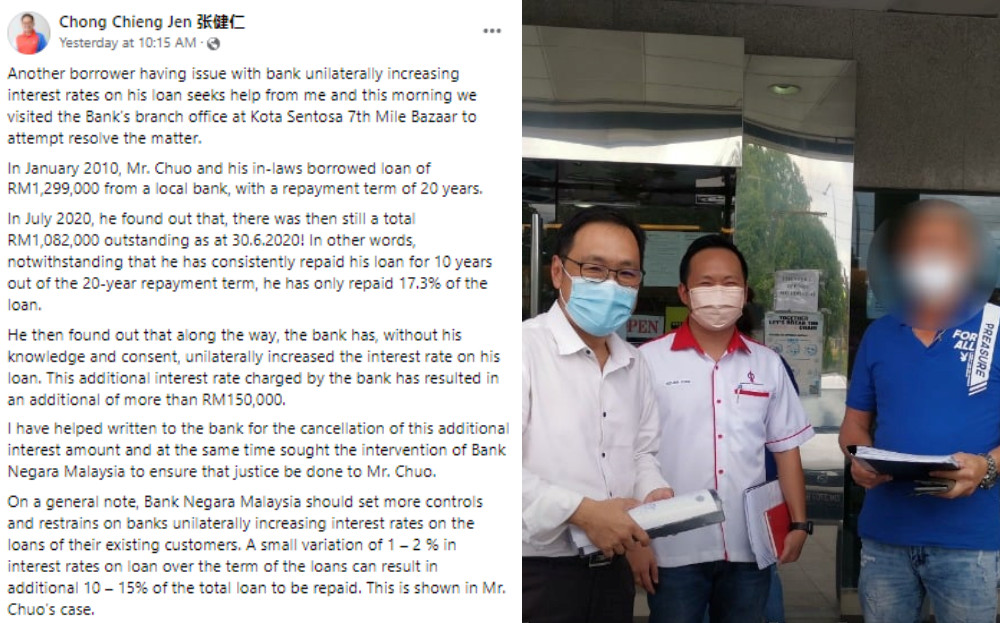

DAP Sarawak State Chairman Chong Chieng Jen (张健仁) released a statement yesterday (31st March) regarding the issue. Apparently, Mr Chong had been approached by a borrower, Mr Chuo. He claimed the bank was unilaterally increasing interest rates on his loan. The borrower hoped Mr Chong would be able to help.

Mr Chuo shared that he and his in-laws had taken out a loan of RM1,299,000 from a local bank in January 2010. The repayment term set was 20 years. However, in July 2020, he discovered they still had an outstanding total of RM1,082,000 as of 30th July 2020. “In other words, notwithstanding that he has consistently repaid his loan for 10 years out of the 20-year repayment term, he has only repaid 17.3% of the loan,” Mr Chong observed.

Later, Mr Chuo found out that the bank had been unilaterally increasing the interest rate on his loan without his knowledge and consent. With the additional interest rate charged, more than RM150,000 was added. Mr Chong explained he had accompanied Mr Chuo to the bank’s branch on 31st March, hoping to resolve the matter. Additionally, Mr Chong has written to the bank asking for the additional interest amount to be cancelled and requested Bank Negara Malaysia to intervene.

However, Mr Chuo is only one case of many. As such, Mr Chong suggested Bank Negara Malaysia set more controls and restraints on banks regarding increasing their interest rates on loans. “A small variation of 1-2% in interest rates on loan over the term of loans can result in (an) additional 10-15%of the total loan to be repaid,” he stated. “This is shown in Mr Chuo’s case.”

Mr Chong hopes rules set by Bank Negara Malaysia will help individuals’ interest be safeguarded. He also hopes it will balance inequality in the free market forces. Additionally, he advised borrowers to regularly check their loan accounts with their banks. That way, they can ensure the interest rates are not being unilaterally increased.

Mr Chuo’s case is definitely frustrating and very unfair. We hope his situation gets sorted, and soon!

Sources: China Press, DAP Sarawak, Facebook

Follow us on Instagram, Facebook or Telegram for more updates and breaking news.