It’s that time of the year again! No, Christmas didn’t come early. We’re talking about filing your income tax.

Preparing and filing your income tax in Malaysia can be a challenging and anxiety-inducing experience every year for most people. Most Malaysians are unaware of the differences between tax exemptions, tax reliefs, tax rebates, and tax deductibles.

But that’s okay! With iMoney’s “The Definitive Guide To Personal Income Tax in Malaysia For 2016”, you can be worry-free this income tax season as you go through their simple and easy-to-understand guide.

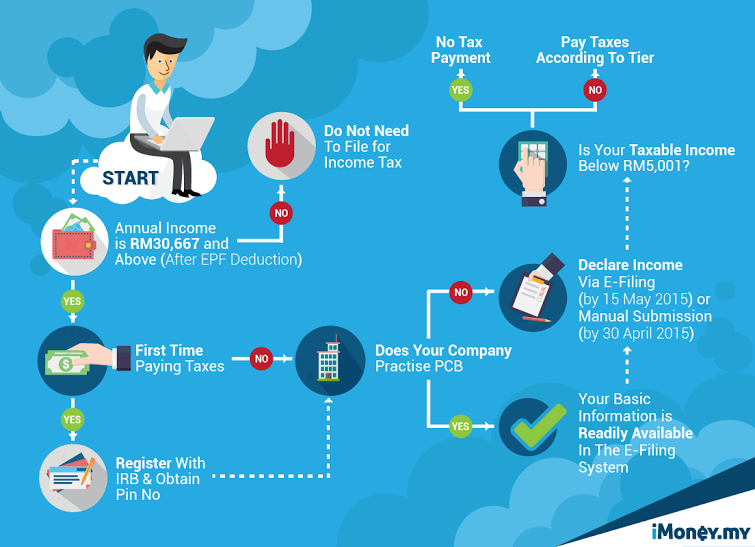

The comprehensive guide which consists of 11 chapters will help you to understand how income tax works from what all the terms mean to how exactly you can file. It includes flowcharts and infographics to simplify concepts and help you file your taxes like a pro.

Examples of what to expect in the guide include:

Equipped with the correct knowledge, filing your taxes will no longer be a daunting task and most importantly you will be able to maximise on the tax reliefs available and get the tax savings you are eligible for.

Thank us later 🙂

Find out everything you need to know about filing your personal income tax in Malaysia by April 2016 with this personal income tax guide.

Follow us on Instagram, Facebook or Telegram for more updates and breaking news.