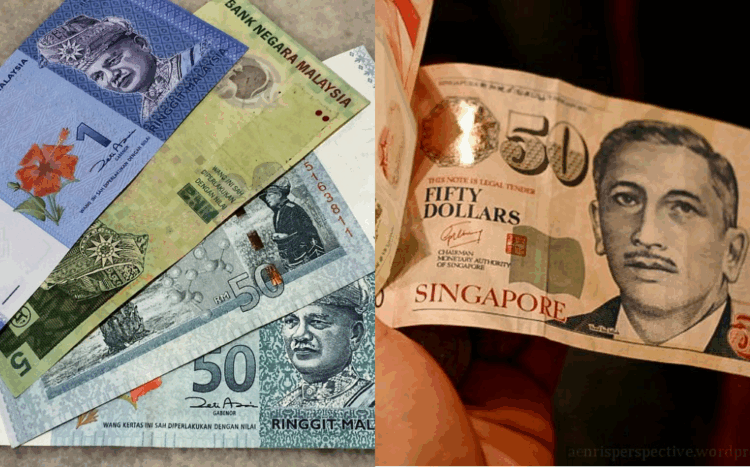

Money makes the world go round. As such, it’s no surprise that people are worried for our national currency, the ringgit (MYR) especially after hearing it has depreciated to an all-time-low, this time against both the US dollar (USD), and the Singapore dollar (SGD).

As at 5pm yesterday (19th October), the ringgit was reportedly traded at 4.764 to the dollar. As for the Singapore dollar, the ringgit had depreciated to 3.48 against it, reportedly making this the highest level of depreciation since Malaysia and Singapore went their separate ways.

The ringgit reportedly depreciated 0.42% against the Singapore dollar at the opening of the market before falling to 3.4958, expending the depreciation to 0.73%. When the market closed, the ringgit was reportedly trading at 3.4797 against the Singapore dollar, down 0.27% from yesterday’s closing price of 3.4702.

According to the New Straits Times, the ringgit’s sudden and worrying depreciation is being caused by two factors, the higher US Treasury bond yields and safe haven US dollar demand. However, they have also reassured that the Bank of Japan (BoJ) and the People’s Bank of CHina (PBoC) are attempting to stablise Asian currencies via intervention.

Some are also concerned that the ringgit may open lower against the US dollar thanks to the current on-going conflict in the Middle East. In an interview with Bernama, Bank Muamalat Malaysia Bhd chief economist and social finance head Mohd Afzanizam Abdul Rashid reportedly stated that in the near term, the currency market would continue to witness a volatile currency landscape.

Worryingly enough, Free Malaysia Today adds that economists have expressed concern that the ringgit could reach the RM5 to a dollar mark. Previously, in 1998, the ringgit hit an all time low of RM4.7250 to the dollar, and this held for almost a quarter century. However, things did change 4th November last year when the ringgit fell to 4.7460 to the dollar.

However, Malaysia University of Science and Technology economist Dr Geoffrey Williams claims otherwise. According to New Straits Times, he believes the ringgit will eventually moderate and will not hit 5.000 to the dollar, and cautions against drastic measures.

As he has told the Business Times: “To strengthen the ringgit, the only real thing is to clarify policy, endure market liquidity and maintain sound fiscal and monetary policy conditions to promote price stability and sustainable growth and investment. These are lessons to be learned from the past.”

Like many others, we too hope things will stablise soon. In the meantime, it might be best to keep an ear out for further news.

Sources: China Press, New Straits Times, Bank Negara Malaysia (1)(2), Malay Mail