The Employees Provident Fund (EPF) Chief Strategy Officer Nurhisham Hussein has stated that individuals will need between RM900,000 and RM1 million to retire comfortably in 20 to 30 years. Previously, a man reached this financial goal by the age of 45 and shared tips on how he managed to save such a significant amount.

However, there are strategies you can adopt to save even more before you turn 40. It may sound too good to be true, but a local woman on social media has proudly shared that she saved nearly RM2 million in her EPF account by the age of 35. Here’s how she did it:

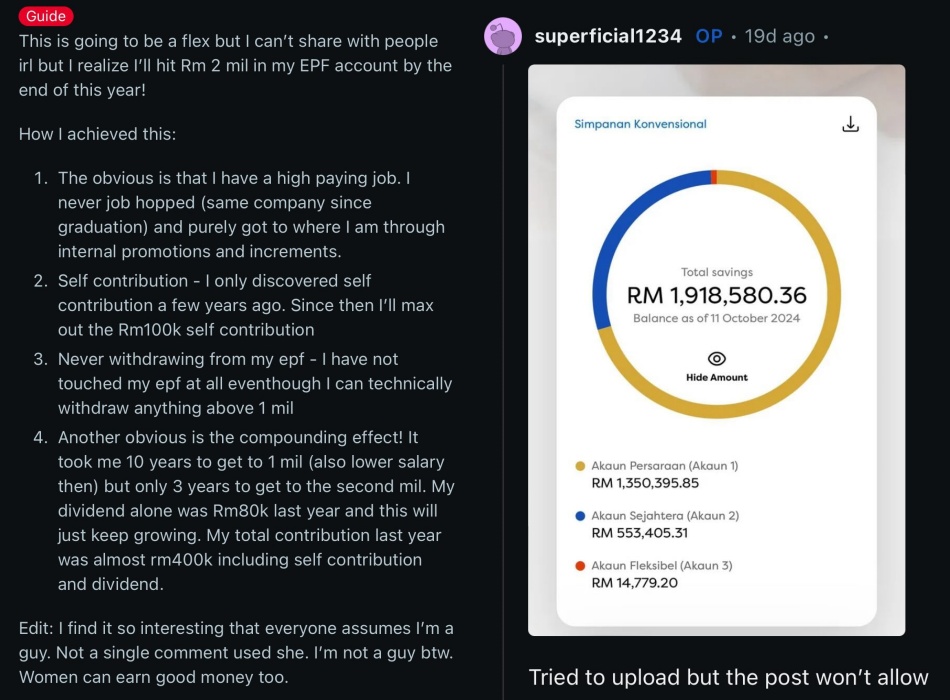

A post originally shared on Reddit has been gaining attention across various social media platforms. A 35-year-old user, known as @/superficial1234, revealed that she will reach RM2 million in her EPF account by the end of the year and shared her journey. Contrary to the common belief that job-hopping is necessary for securing higher salaries, this user has remained with the same company since completing her studies.

“The obvious is that I have a high-paying job. I purely got to where I am through promotions and increments,” she said. Apart from that, there are three other practices that have helped her achieve her financial goals which are:

- Self-contribution: An option for those who want to voluntarily grow their retirement savings with EPF. The woman contributed the maximum annual amount of RM100k to her account.

- No EPF Withdrawal: Members have the option to withdraw from their account if they have more than RM1 million, however, the Reddit user refused to do so as she has no need for it so far.

- Compounding Effect: It took her a decade to reach RM1 million but only 3 years to reach the second million. She earned RM80k in dividends just last year, bringing her total contributions—including dividends and self-contributions—to about RM400k.

After the post went viral, some netizens criticised the woman for “showing off” her wealth and even doubted her milestone, while many others came to her defence, arguing that people should learn to invest and take inspiration from her journey to achieve a comfortable retirement. While having RM2 million in savings is impressive, ultimately, age isn’t the determining factor; what matters is having sufficient funds when you choose to retire.

What do you think?