The Employees Provident Fund (EPF) has announced its i-Sinar advance facility, which will permit eligible members to take up an advance from their Account 1.

The scheme is an initiative which aims to assist active members who lost their jobs, given no-pay leave, or have no other source of income due to the Covid-19 pandemic.

The new scope means i-Sinar will now benefit 2 million members, resulting in a total estimated value of RM14 billion made available. EPF said that eligible members can start applying from December, and the funds will then be credited into members’ bank account by the end of the month following their application submissions.

“First crediting will take place in January 2021. Advances will be made over a period of six (6) months from the first date of crediting,” stated the pension fund. As a whole, eligible members will be able to access 10% of their savings in Account 1 as long as they have a minimum balance of RM100.

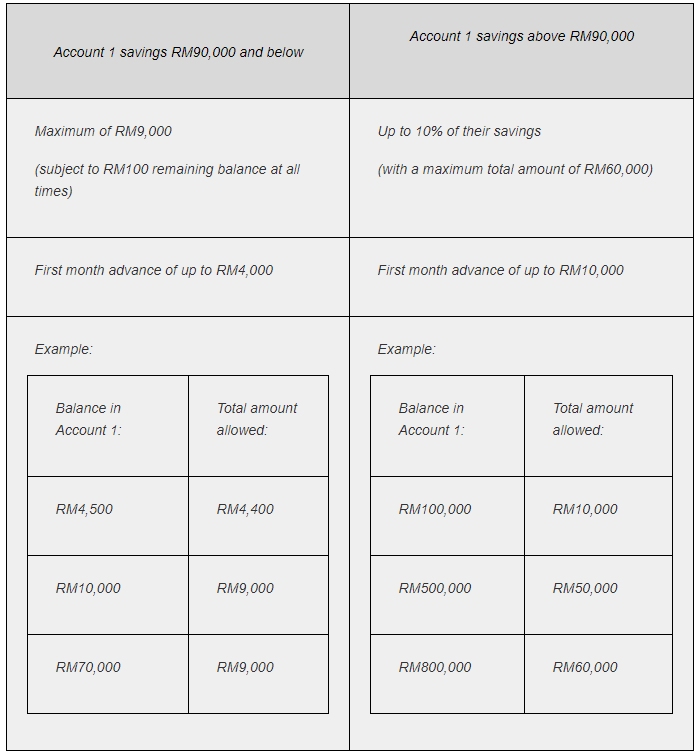

For those with Account 1 savings of RM90,000 and below, you can access any amount of up to RM9,000. The amount advanced will then be staggered over a period of 6 months with an increase in the first advance of up to RM4,000.

Meanwhile, those with a balance of RM90,000 and above in their Account 1 can access up to 10% of their savings (the total amount capped at RM60,000). The advance amount will also be staggered over a period of 6 months with an increase in the first advance of up to RM10,000.

Take note that i-Sinar is an advance and not a withdrawal, meaning members who apply for the facility will be required to replace the full amount advanced with all future contributions to be fully credited to Account 1, until the amount advanced is replenished. After that, contributions will revert back to usual, 70% to Account 1 and 30% to Account 2.

According to EPF, more information and full details on the i-Sinar eligibility and terms and conditions will be available soon.

Source: EPF