Life as a modern millennial is hard enough without added pressures. The state of the economy, increasing living expenses, looming student debts; and the list goes on. As we slowly learn to navigate through adulthood (and now, a pandemic), a new question has arisen for us. The Covid-19 pandemic has gotten everyone worried about our health, but how truly concerned are we?

When was the last time we made sure that we had sufficient financial protection in the case of a medical emergency? In addition to medical costs, you may need to factor in other expenses including loss of income or lifestyle changes due to mobility and dietary. Are you certain that you’re equipped with the necessary financial means when life strikes unexpectedly?

Firstly, let’s clarify one thing; you may have heard of medical insurance and critical illness insurance. They are not the same. A medical insurance plan typically covers the cost of hospitalisation such as your room and board, your treatment, and medicine costs. A critical illness plan, on the other hand, provides a lump sum cash payout when you are diagnosed with a critical illness such as a heart attack, stroke, or cancer. That being said, here are some reasons why you should consider having critical illness insurance even if you already have a medical plan.

1. One Worry Off Your List

With the stressful lifestyle that we lead (paired with awful sleeping times), when did we last take a step to ensure that we are protected in a worst-case health-related scenario? With critical illness protection, you would be protected financially and can fully focus on healing and getting your life back on track.

A great example would be the ferocious Emily Tan, a dancer who fought all the odds against leukaemia. After all, critical illness does not discriminate against age or fitness level, as seen in Emily’s case.

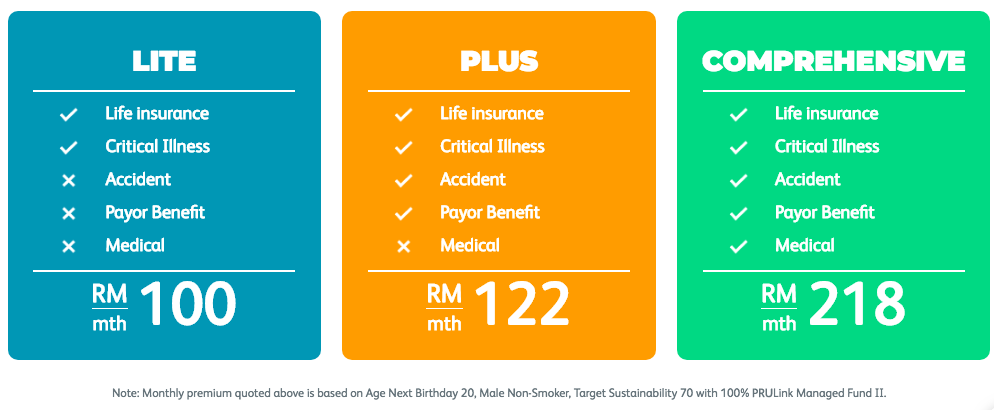

2. No matter your needs, there’s a plan for you

As working millennials, it is understandable that we have commitments to settle every time our paycheque comes in. From rent, to down payments and student loans; it’s safe to say that there isn’t much room for extravagant spending. This is why Prudential’s PRUMy Critical Care solution is the perfect in-between ground. Their critical illness protection solution starts from as low as RM100 and covers 160 conditions. This way you can get critical illness protection without making a huge dent in your bank account.

3. Coverage From Early to Late Stages

A very important point to remember when getting critical illness insurance is to make sure that you are covered during all stages of your illness. PRUMy Critical Care ensures that you will be protected, providing peace of mind. You are entitled to 50% of the rider sum assured upon diagnosis for early detection but if you are diagnosed during a late stage, you are entitled to 100% of the rider sum assured. Therefore PRUMy Critical Care’s solution can be incredibly helpful when times get tough.

4. Lessen Financial Burden

Do you find the need for health insurance to be an unnecessary extra step? Especially since your company health card already has enough coverage in cases of emergency. Why should you fork out more money monthly? The answer is simple: you need to be prepared. If anything, the Covid-19 pandemic has given most of us a reality check on how truly fleeting life can be; and it’s always worth fighting for.

While a company health card may be adequate for regular, everyday occurrences— we still need to prepare for the worst-case scenarios that are yet to come. With critical illness protection, it adds on to your regular medical insurance coverage. As critical illness insurance plans provide a payout if you are diagnosed with a critical illness, you will be able to lessen your financial burden.

5. Premium Increases with Age

Arguably the best reason to get insurance now, is a noted fact that insurance premium gets more expensive as you get older because your health risks increases. It’s best to invest now and be prepared for the future, where you would be thanking your younger self for thinking ahead.

Take Jared Lee and Marianne Tan for example, who were starting to plan their next chapter in life before disaster decided to strike. Luckily for Jared, he was already covered so he was able to beat testicular cancer without suffering a huge financial blow and fully focus on recovering. Watch their story here:

All of these benefits combined, you’d think it builds a pretty solid case as to why you should get covered for critical illness with your healthcare now! Reinvent the stigma of ‘being too young to get insurance’ and protect yourself now for a better tomorrow. Find out more about Prudential’s critical illness solution today here.

Bonus:

6. Get Personal With Your Health

There are around 2.5 million people in Malaysia who use health/fitness apps in their daily routines. If you’re looking for the right app to monitor your health with ease, Prudential has recently launched their #StepUpAgainstCancer Challenge for non-Prudential customers to earn up to RM12,500* free cancer coverage via the Pulse app!

This challenge is open to non-Prudential customers who are Malaysian Citizens aged 19-50 on their next birthday. All you need to do is make sure you download the latest Pulse app, sign up for #StepUpAgainstCancer Challenge, and you’ll get to start the challenge with RM500 cancer coverage.

Reach a step count of 5000 steps daily to earn up to an additional RM10,000 for cancer coverage within 100 days, from the first day of sign up. You’ll also get additional RM200 coverage amount when a new registered Pulse user successfully signs up with your invite! This way, you can earn up to RM2000 additional coverage amount within 100 days, starting from the first day of your sign up.

By joining the challenge, you get to stay fit and start making positive changes to your lifestyle accordingly. The motivation can lead up to simple things, such as the need to walk to a further location for lunch or walking to the LRT station instead of taking a ride-sharing service home.

Another bonus for you!

Users who sign up for the challenge are also automatically eligible for Prudential’s Special Covid-19 Coverage. The coverage provides a RM1,000 cash relief upon diagnosis and hospitalisation, as well as a RM10,000 death benefit due to Covid-19.

What are you waiting for? Download the Pulse app now to participate here. To find out more about #StepUpAgainstCancer Challenge, click here.

*Terms and conditions apply.

{{CODE1}}