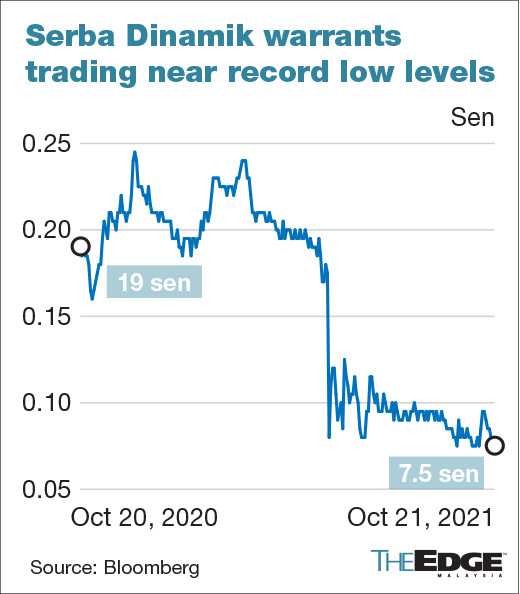

Things aren’t looking good for Serba Dinamik Holdings Bhd. The group’s managing director and chief executive officer Datuk Mohd Abdul Karim Abdullah has disposed of his entire holdings of 55.9 million of group’s warrants this week. Not a moment too soon, as the price of warrants have been hovering at near record low levels.

It’s clear that the chief is pulling out and many retail investors are at a loss. Some suspect trickery from Abdul Karim to force panic buying. Others however are of the opinion that the group will not recover.

Yesterday (21st October), Serba Dinamik reported in a bourse filing that Abdul Karim had sold the group’s warrants in 4 batches this week. He cashed out an approximate total of RM4.35 million. On Monday (18th October), he sold 21.85 million warrants at a price of 8.13 sen each. He cashed out approximately RM17.5 million. On Wednesday (20th October), 21.2 million warrants were sold at 7.5 sen then later, another 12.9 million at 7.7 sen. Yesterday, a further 123,600 warrants were disposed for 7.5 sen each. In total, Abdul Karim sold about 6.34% of the group’s total warrants.

As of 4th October, Abdul Karim held 786.38 million shares (21.2% stake) in Serba Dinamik. However, his recent actions have caused a stir among retail investors. Some are hoping for a turnaround, cautioning patience and attentiveness. Others however claim it’s over for the company. “The boss ran away, it’s miserable,” one comment said.

During the week, Serba Dinamik’s warrants prices fluctuated between 7.5 sen – 8 sen. On Thursday however, it closed at 7.5 sen. It’s price took a hit at the end of May after the group’s then external auditor KPMG flagged some accounting issues. The firm later resigned as their external auditor on 24th June after a suit by Serba Dinamik. A new external auditor, Nexia SSY PLT was appointed by the group in August.

The group currently has a market capitalisation of RM1.38 billion. It’s share price closed one sen or 2.6% lower at 37 sen yesterday. It’s a far cry from it’s stable stock price in May which remained between RM1.60 and RM1.80. It even reached RM2 at one time.

Sources: China Press, The Edge Markets, i3 investor.com